Budgeting

A Gallop poll showed that only 1/3 or 32% of Americans’ keep a formal budget and 50% of Americans’ have less than one month’s worth of income saved in case of an emergency. If you are just starting to create a budget or revisiting your current budget, below are some tips and information on how to get started.

Where do I begin?

Many people are not sure where to begin taking control of their finances. A good place to start is establishing what financial goals you would like to achieve. Doing this will help you start planning for the long-term.

Smart Money Goals

Whether your aim is to pay off your credit card debt, save for retirement, or work on another money goal, learning how to set S.M.A.R.T financial goals will ensure that you achieve your objectives.

What is a S.M.A.R.T goal and how to you set one?

SMART goal-setting allows you to make concrete and specific plans around your goals. Instead of saying, “I want to pay off my debt,” or “I want to save money for the future” you reshape your goals to give yourself tangible objectives such as, “I will pay off $5,000 in credit card debt in 2021” and “I will save $1,000 for a family vacation at Christmas.” Setting specific goals with your money will put your hopes into action.

Where Do I Start?

Write down some ideas that you would like to improve upon in your financial life. After you identify specific goals, apply a time frame to make them measurable.

Common Mistakes

There are 3 common mistakes people make when they set financial goals.

- They focus on the result instead of how much they need to set aside.

- They set too many goals to start with.

- They get frustrated and give up when they are having a hard time staying on track.

SMART Money Goals Resources

![]()

Special Tip!

Don't get frustrated! Managing your money and setting financial goals is a learning process; there will be setbacks along the way, but it will be easier with practice once you get the hang of it.

Now that you know how to lay out your financial goals in a S.M.A.R.T. way, you will be on your way to achieving them!

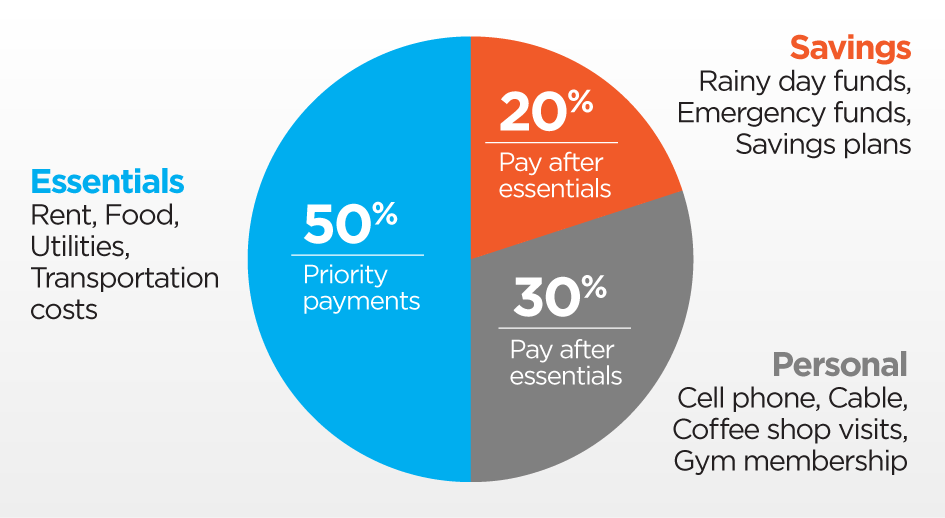

The 50/20/30 Rule

The goal of the 50/20/30 Rule is to break down your monthly take-home income and focus your spending in three broad categories listed below.

50% Essential Living

This category is for:

- Essential Bills

- Rent or Mortgage

- Utilities

- Groceries

- Insurance

- Car Payment

20% Financial Goals (Savings & Debt)

This category is for:

- Savings

- Any debt

- Investments. This includes your 401(k) and all other investments.

30% Personal Spending

This category is for items you like to spend money on but don't really need such as:

- Eating out

- Vacations

- Movies

- Netflix or in-home entertainment

- Shopping for clothes

- Home decor

Simple 50/20/30 Budgeting Breakdown

Tips for Success with the 50/20/30 Rule

- If your monthly bills are higher than 50% of your income, you may want to review your bills and determine if there are any additional savings.

- Review your personal spending. How often do you eat out? How often do you go out to lunch during the work week?

- Take a hard look at your cable, internet, and phone bills. Ask yourself, do you need all the premium channels or services?

- Shopping. Try and set a budget for yourself.